By Wayne Byrd, CFO, Skyline Group of Companies.

On October 23, the Bank of Canada (BoC) is scheduled to meet for a seventh time in 2024 to set its key overnight rate target. The meeting comes amid widespread expectations the BoC will cut rates for a fourth time in 2024, buoyed by supportive economic data. Should the central bank cut as expected, rising economic output could manifest as the cumulative effect of rate cuts increasingly takes hold.

Unlike the previous three meetings where the BoC cut overnight rates by 25 basis points, this meeting is garnering particular interest after Statistics Canada reported annual inflation fell to 1.6 percent in September. Not only was this the lowest reported total Consumer Price Index (CPI) figure since February 2021 (the depths of COVID), CPI is now below the central bank’s median core inflation target of 2 percent.

Meanwhile, manufacturing activity—the lifeblood of Canadian business commerce—remains sluggish across much of Canada.

According to the latest Monthly Survey of Manufacturing numbers released on October 16, total manufacturing sales declined 1.3% in August, largely on lower sales of primary metals as well as petroleum and coal products. This, in effect, reversed the 1.4 percent gains reported in July. Such a reversal does not signal well for a robust GDP report on October 31, which some analysts predict could come in flat or worse.

Collectively, cooling inflation combined with sluggish economic growth gives the BoC ample maneuverability to cut rates by 50 basis points. With overheating inflation no longer an imminent concern, it may make sense for a ‘jumbo’ cut to jumpstart economic activity in order to instill confidence and inject consumer purchasing power into the system. Such action would serve to pull demand forward and promote capital investment along the economic spectrum.

Such is the prevailing logic among bond traders, with Canadian Bonds pricing in a 67% chance for BoC rate cut of 50 basis points (as of October 15). Movement in the Government of Canada 5-year Bond is especially noteworthy for 5-year fixed-rate mortgages since mortgage interest rates closely follow this instrument.

Thus, with bond yields selling off to near 2024 lows on the eve of the BoC policy meeting, optimism abounds the BoC will take the Federal Reserve’s lead to embrace a jumbo cut in relatively normal economic conditions.

Former BoC Deputy Governor Believes a 50-Basis Point Cut is Needed

On the back of recent economic data, former Deputy Governor Paul Beaudry expressed “good reasons”

to move interest rates “back to as close to neutral as quickly as possible.”

Citing the need to boost household and business optimism, Beaudry believes “getting confidence going”

is the best course of action with the overnight rate well below natural equilibrium.

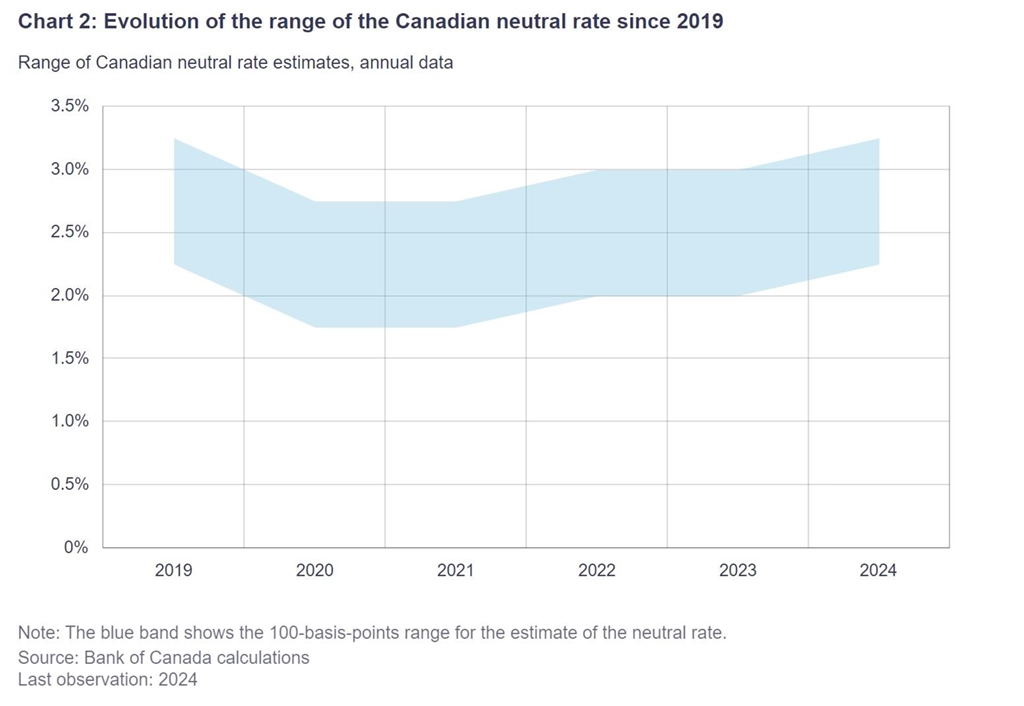

How much so? The current overnight rate of 4.25 percent is at least 100 basis points higher than the BoC’s neutral rate, or the rate that neither stimulates nor restricts economic growth. Although the neutral rate is unobservable and inferred by assessing the evolution of factors at the BoC, it nevertheless provides a theoretical baseline of where rates could fall as the BoC’s cutting cycle progresses.

Indeed, several analysts have backed Mr. Beaudry’s assessment that a strong BoC response is needed.

Economist Tu Nguyen of RSM Canada expressed her surprise at the recent inflation data, which she initially expected to stay close to the central bank’s two percent target for several months. Nguyen noted that while the BoC has generally favored a gradual approach to rate cuts—typically reducing rates by 25 basis points—recent inflation reports suggest a growing possibility of a more aggressive 50 basis point reduction.

Echoing this sentiment, Royce Mendes, managing director at Desjardins, indicated that the likelihood of a 50-basis-point cut is increasing due to the underperformance of the domestic economy and the significant challenges that lie ahead. He stated, “We expect the Bank of Canada will cut rates by 50 basis points this month, with the domestic economy underperforming and significant challenges on the horizon.”

A similar sentiment was shared by Andrew Kelvin, head of Canadian and global rates strategy at TD Securities. Mr. Kelvin highlighted the urgency for the BoC to adjust its rates more quickly than its U.S. counterpart, pointing out that the BoC is “well behind the curve when it comes to rate cuts.”

He further emphasized that slower growth in Canada necessitates a faster move toward achieving a neutral rate.

For our part, we agree that conditions are optimal for the BoC to cut aggressively. Not only are recent core inflation and GDP prints flashing a solid green light, but a faster move to the neutral rate could offer relief to heavily indebted Canadians and foster increased consumer spending.

In turn, increasing economic output would provide a tailwind for retail and industrial real estate assets whose fortunes are inextricably linked to a strong economic cycle.

Real Estate Prices React to Recent Rate Cuts

While sales activity is increasing, property values have not escaped exit velocity due to BoC action thus far. However, there’s evidence to suggest the BoC’s 2024 rate cuts are taking effect. On the residential side, latest numbers from The Canadian Real Estate Association (CREA) show positive signs of upward directional movement.

According to the metrics reported on October 15, national home sales rose 1.9 percent month-over-month in September, while the composite MLS Home Price Index (HPI)—a tool developed by CREA that tracks changes in home prices across different markets in Canada—increased by 0.1 percent during that span. While the price increase was modest, the gain comes amid an overall 3.3% HPI decline on a year-over-year basis.

Of significance, all gains in the composite CPI have occurred in the three months following interest rate cuts, which hasn’t occurred organically in a non-rate cut month since July 2023. While that’s not enough sample size to draw definitive conclusions, the data infers that BoC action is starting to move the needle.

25 or 50?

Whatever course of action the BoC decides on October 23, the market is expecting further cuts at, or below, the neutral rate through the first half of 2025. It now becomes a question of whether the BoC wants to ‘shock’ the market with a 50 basis point cut—something the BoC traditionally has shied away from in non-crisis times and something not attempted since the depths of COVID in March 2020. However, the recent decision by the Federal Reserve to lower its federal funds rate by 50 basis points in non-crisis times clearly shows that central banks will leverage policy tools to foster economic activity when conditions are appropriate.

For the sake of up to 2 million variable-rate mortgage holders and tattered consumers alike, bold is beautiful in the present environment.

About Skyline Group of Companies

Skyline Group of Companies (“Skyline”) is a fully integrated asset acquisition, management, development, and investment entity.

It is comprised of companies that provide services in real estate management and development, as well as clean energy management and development.

Skyline currently manages more than $8.23 billion across its real estate and clean energy platforms.

With approximately 1,000 employees across Canada, Skyline works to provide safe, clean, and comfortable places for tenants to call home, great places to do business, sustainable solutions for a greener future, and an engaging experience for its investors.

View Skyline’s 20th Anniversary celebration video to see how Skyline is grounded in real estate, powered by people, and growing for the future.

For more information about Skyline Group of Companies, please visit SkylineGroupOfCompanies.ca.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

cbeverly@skylinegrp.ca