With U.S. President Donald Trump’s ascension into the Oval Office, the policies behind his rhetoric are coming into sharper focus. Specifically, his intention to levy steep tariffs on Canadian imports are garnering significant attention north of the border. With Trump signaling his intention to impose a 25% tariff early in his presidency, it’s a threat Canada must take seriously. While the economic drawbacks are evident, the situation is not entirely bleak. Trump tariffs have already prompted significant policy and political shifts in Canada and may still yield unexpected trade benefits.

This article seeks to quantify how tariffs might impact the Canadian economy from an industrial real estate point of view.

Enhanced trade unions and economic partnerships

With around 2.4 million Canadian jobs exposed to U.S. tariffs, Trump tariffs represent a material risk to Canada’s economic order. Such action—depending on if, and how, we retaliate—could sink the Canadian economy into recession. While many key industries, particularly the auto sector, are so deeply integrated across borders that tariffs will cause significant sticker shock to the final output. Over 91% of Canadian auto parts are exported to the U.S., with some crossing the Canada-U.S. border up to eight times before becoming part of a finished product.

Given this environment, it’s no surprise that Canada’s government and corporate leaders have been working feverishly to defuse the situation before it escalates. Take Premier Doug Ford, for instance.

Recently, the province of Ontario outlined a plan to achieve bilateral energy security and power economic growth on both sides of the border as part of ‘Fortress Am-Can’. This proposed strategic alliance between Canada and the U.S. seeks to capitalize on Ontario’s unique advantages, boosting U.S. job creation by expanding the integrated energy and electricity grid and increasing Canadian energy exports to the U.S. Interestingly, the news release notes that Mr. Ford’s “ambitious plan to build up Fortress Am-Can to usher in a new American and Canadian century” can only be done by “working together and respecting each other.” The clear desire to strengthen its partnership while reducing divisiveness is noteworthy.

British Columbia Conservative Leader John Rustad has also weighed in, calling for the provinces to re-open independent international trade offices in Asia, including in China, to counter tariff threats. Rustad’s comment came just days after B.C. Premier David Eby said he will be seeking to diversify trade partners, ensuring we’re in a position to respond to replace U.S. customers.

Even prominent Canadian entrepreneur Kevin O’Leary joined the conversation after Trump suggested Canada become our 51st state.

O’Leary expressed interest in meeting Trump to discuss the idea of an economic union

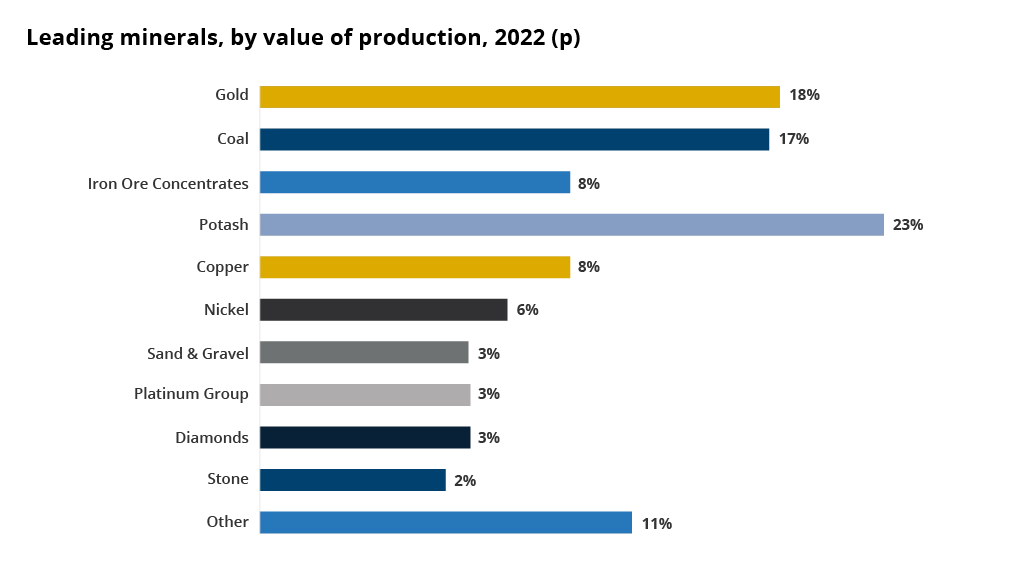

between the U.S. and Canada. He further highlighted America’s growing demand for energy and natural resources, noting that Canada’s abundance in these areas could provide immediate mutual benefits.

O’Leary joined Alberta Premier Danielle Smith recently at Mar-a-Lago to discuss the mutual importance of the U.S. – Canadian energy relationship, underscoring the need to avoid a trade war and seek common solutions. This is especially true following Trump’s overtures to purchase Greenland — an idea based mainly on Greenland’s vast mineral and hydrocarbon deposits. To that end, Canada and Greenland share many commonalities: resource rich, military importance due to their northern proximity to Asia, extensive access to far-north shipping lanes, freshwater reserves and fishery stocks.

The new administration’s view of Canada as a resource hub may not prevent a trade war from transpiring. However, from our perspective, the most likely long-term goal—rhetoric aside—appears to be the expansion of trade partnerships. It is difficult to conclude otherwise given Trump’s strategic interest in Greenland.

Skyline takeaway: Whether the full impact of tariffs materializes has become almost secondary. The threat has already catalyzed major U.S. trading partners to diversify their export channels and reduce reliance on the U.S. Once established, these bilateral trade routes will likely have a lasting positive impact on non-U.S. trade volumes, even after U.S. trade relations normalize. This diversification of export pathways is a long-term net positive for industrial activity and related infrastructure development. The new administration’s interest in Greenland is a major indicator that the U.S. is interested in Canada’s natural resources, countering a broad-based trade war narrative.

Can a pro-growth government drive lagging business investment?

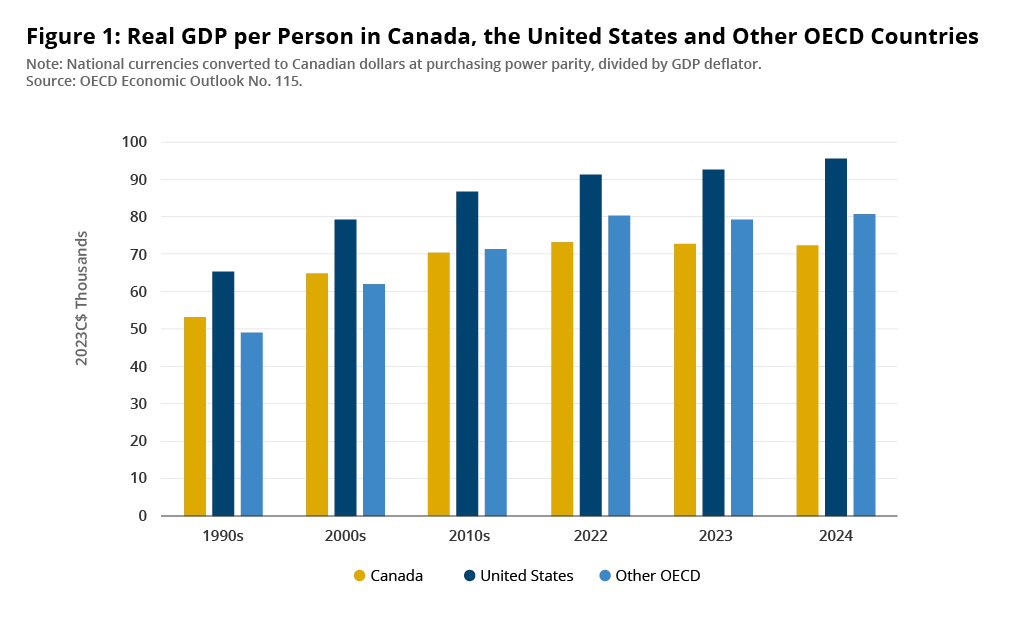

New business investment and capital expenditures (CAPEX) are the lifeblood of any economy. Without it, economies risk losing competitiveness and the resources necessary to sustain future economic growth. While the economy can typically withstand delayed investments without dire short-term impact, prolonged impairment can affect long-term economic growth potential. Canada is already confronting this challenge, as the gap in GDP per capita between the U.S. and other OECD countries continues to widen, driven largely by weak business investment.

Even without a new tariff paradigm, Canada is already experiencing subdued growth, as evidenced by six consecutive quarters of declining per capita GDP. New tariffs will undoubtedly serve to prolongate this trend, as policy uncertainty compels companies to postpone investment decisions or reevaluate their supply chains amid concerns over trade disruptions.

The negative effects of tariffs extend beyond their immediate impact, potentially influencing consumer spending and broader economic activity. Higher tariff costs raise prices in Canada, reduce business profits, and often lead to increased expenses for imported goods passed along the supply chain. This diminishes price competitiveness and results in lower unit sales. Additionally, the lingering uncertainties of potential trade war escalations imposes further risks on businesses, making them hesitant to commit to new capital investments.

Despite these threats, the possibility, of tariffs may have contributed to the timing of a federal election in Canada, where current projections suggest one party are currently on track to secure a supermajority—two-thirds or more—of the seats in Parliament.

In late November, Canadian Prime Minister Justin Trudeau made an urgent visit to U.S. President Donald Trump at Mar-a-Lago shortly after the announcement of proposed tariffs. Less than a week later, Trudeau sought to reassign then-Finance Minister Chrystia Freeland to a less prominent diplomatic role. This decision led to Freeland’s immediate resignation, resulting in significant disruption to Canada’s economic negotiating team. Remarks made by Trump following Freeland’s resignation suggest he may have exerted pressure on Trudeau to implement the controversial reassignment.

Amid the ensuing chaos, the departure of one of Trudeau’s top lieutenants set the stage for Liberal caucus turmoil, prompting his own resignation on January 6, 2025. With the prospects of federal elections around the corner, a shift in Canada’s political landscape appears inevitable.

Skyline takeaway: While tariffs are bearish for industrial real estate in the short term, the pre-U.S. inauguration threat of tariffs has likely accelerated Canada’s electoral timeline. With the Conservative Party expected to win a majority in Parliament, Canada could shift towards a more pro-business climate by year-end. Such a shift could also decrease the odds of long-term Canada-U.S. trade friction in key industries. Additional pro-business policies, such as abolishing the carbon tax, would positively impact business investment, resulting in an increased demand for industrial real estate.

Incentivized realignment of trade barriers between the provinces?

For many, trade barriers are viewed as protective measures designed to shield domestic industries in international trade. However, these barriers also exist domestically between the provinces within Canada. More than just symbolic constructs, inter-provincial trade barriers impose tangible costs on the goods consumers purchase daily.

For example, it is estimated that inter-provincial trade represents around one-fifth of the country’s gross domestic product, with barriers adding between 7.8% and 14.5% to the price of goods and services. Since private consumption in Canada accounts for 54.1% of nominal GDP as of September 2024, that’s a significant hidden ‘tax’ imposed on everyday Canadians.

While business groups quietly lobby the provinces on streamlining areas of red tape, only moderate progress has been made to date.

In their ‘State of Internal Trade’ report card for 2024, the Canadian Federation of Independent Business (CFIB) graded federal, provincial, and territorial governments’ interprovincial cooperation efforts on reducing barriers to internal trade between provinces. This report card evaluated interprovincial and territorial cooperation across three key areas: exceptions within the Canadian Free Trade Agreement (CFTA), the presence of inter-jurisdictional barriers to internal trade, and the progress made in implementing items from reconciliation agreements.

Among the thirteen provinces, territories, and the federal government, only one received an ‘A‘ grade, while four earned ‘B’ grades, six received ‘C’ grades, and four were assigned ‘D’ grades for their overall performance. The data clearly infers that in the absence of a galvanizing catalyst, progress to reduce inter-provincial trade barriers has been slow.

But could an existential threat to the economy change this dynamic? Some economists are noting that with a hawkish Trump administration taking office, movement of inter-provincial trade could be the antidote to mitigate prolonged tariff damage.

This makes perfect sense when you consider that if sweeping tariffs of 10% to 25% on Canadian imports are implemented, the economy could face a nominal GDP impact of $30 billion to $78 billion, depending on the scenario. As damaging as that is, these forecasts are dwarfed by the estimated cost of inter-provincial trade barriers, which cost the Canadian economy as much as $200 billion per year, or $5,100 per person.

Put another way, streamlining domestic trade has the potential to fully offset the economic impact of Trump-era tariff, even under the most dire of retaliatory forecasts. It seems almost too logical not to be implemented.

Skyline takeaway: While Trump tariffs could materially impact Canadian GDP, the provinces may be able to mitigate the effects. Many of these measures are straightforward but demand the political will to prioritize a Canada-first framework. Tariffs from Canada’s largest trading partner may provide the necessary catalyst for decisive action.

About Skyline Group of Companies

Skyline Group of Companies (“Skyline”) is a fully integrated asset acquisition, management, development, and investment entity.

It is comprised of companies that provide services in real estate management and development, as well as clean energy management and development.

Skyline currently manages more than $8.23 billion across its real estate and clean energy platforms.

With approximately 1,000 employees across Canada, Skyline works to provide safe, clean, and comfortable places for tenants to call home, great places to do business, sustainable solutions for a greener future, and an engaging experience for its investors.

View Skyline’s 20th Anniversary celebration video to see how Skyline is grounded in real estate, powered by people, and growing for the future.

For more information about Skyline Group of Companies, please visit SkylineGroupOfCompanies.ca.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing and Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

519.826.0439 x602