The Bank of Canada’s recent decision to cut interest rates marks a significant turning point in the economic landscape. As the first G7 country to take this step, Canada is signaling a strategic shift aimed at easing financial pressure on consumers and stimulating economic growth. For investors, this may present an opportunity to re-enter the investment marketplace.

Understanding the Interest Rate Movement

Reasoning behind the recent rate cuts

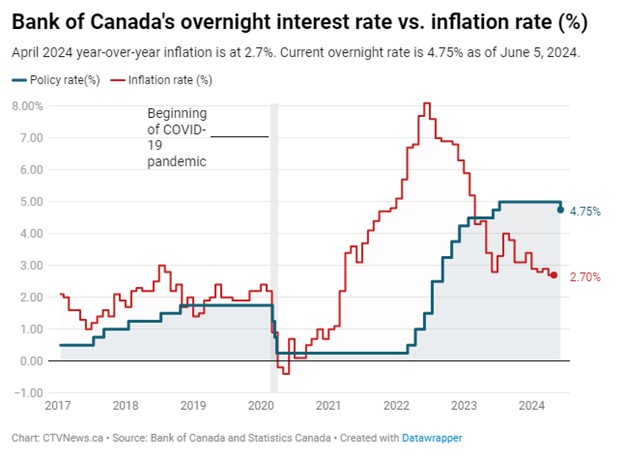

The Bank of Canada’s decision to trim its key policy rate to 4.75% comes after a period of high interest rates aimed at combating inflation. With inflation now showing signs of easing, as well as a slowdown of economic growth, the central bank took the initiative leading to a rate cut.

This move should provide relief for indebted consumers and businesses, encouraging more borrowing and investment activity in the coming months – especially as this is the first of more potential rate cuts to come. Bank of Canada Governor Tiff Macklem stated that further rate cuts will depend on continued positive economic data, particularly around inflation.

Economic indicators and market conditions

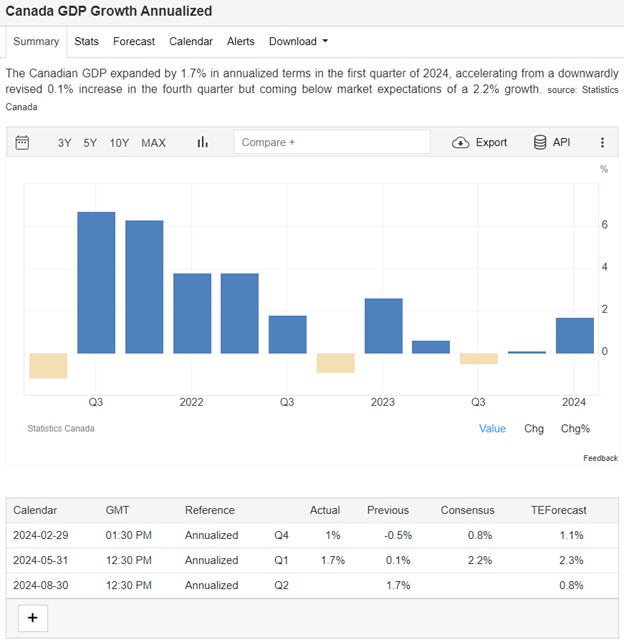

Recent economic indicators such as GDP growth, unemployment rates, and consumer spending patterns have pointed toward a slowing economy. The first quarter of 2024 saw GDP growth lower than expected, at an annualized rate of 1.7%, further supporting the rationale for rate cuts.

Experts predict that as inflation cools, interest rates will gradually decrease, paving the way for improved economic conditions. The economic slowdown necessitates some easing of rates, which are still considered to be at a “restrictive level.” for the economy, so some easing will be needed if the economy is indeed slowing.

Market trends

A key characteristic of public market investments is their forward –looking nature. To determine the intrinsic value of public investment vehicles like stocks, bond funds, and ETFs, analysts take forecasted future information discounted to today’s price to determine whether an asset is worth buying or selling. Interest rate decreases have already been priced into the public market’s models—which is partly why the market has generated strong positive returns year-to-date.

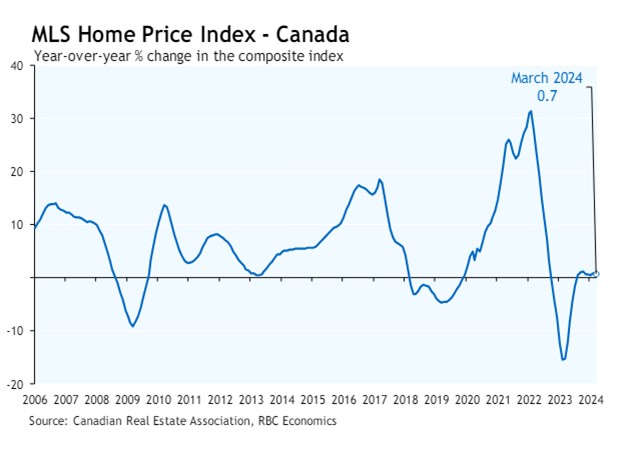

Conversely, real estate is different, individuals and corporations may receive higher borrowing amounts once interest rates come down. In other words, we may not experience the impact of higher real estate demand and pricing until interest rates actually fall.

Real Estate Market Dynamics

Interest rates and real estate cap rates

Cap rates, or capitalization rates, represent the return on investment properties and are correlated with interest rate activity. When interest rates decrease, cap rates tend to compress, making real estate investments more attractive. This compression is a result of lower borrowing costs and increased demand for real estate assets. Historically, periods of declining interest rates have coincided with falling cap rates, leading to higher property values.

Impact on real estate values

As cap rates compress, the value of real estate properties tends to rise. Lower interest rates reduce the cost of financing, enabling investors to pay more for properties while maintaining desired returns. This increase in property values should be a key driver for investors to re-enter the market now, while rates decrease and value increases. With interest rates expected to continue their downward trajectory, the potential for real estate value appreciation is anticipated.

Strategic Moves for Investors

Opportune time to invest

The current economic environment presents a unique opportunity for investors to move from cash back into real estate. The recent interest rate reduction indicates that public markets bottoming out may have been reached and economic recovery—or even a new boom—is forthcoming. Investing in real estate now allows investors to benefit from anticipated property value increases and favourable financing conditions. However, investors should always consider potential risks, such as market volatility and changing economic conditions, and develop strategies to mitigate them.

Sectors to watch

Within the real estate market, certain sectors are poised to offer significant returns. Residential real estate, particularly in urban areas, is experiencing high demand due to population growth and immigration. Retail real estate, notably properties in secondary markets, offers opportunities for value maximization with lower acquisition costs. Industrial real estate is also gaining popularity, driven by the e-commerce boom and supply chain demands. It is interesting to note the interplay among these sectors, with population growth spurring not only the demand for housing, but also convenient access to in-person shopping for essential goods (retail) and delivery (industrial).

Historical Analysis and Market Predictions

Historical impact of interest rate cuts on Canadian real estate

Historically, interest rate cuts by the Bank of Canada have had a significant impact on the real estate market. For instance, during the financial crisis of 2008-2009, the central bank reduced interest rates to stimulate the economy, which led to increased activity in the housing market. Similarly, during the COVID-19 pandemic in 2020, the Bank of Canada slashed interest rates to near-zero levels. This move significantly boosted the housing market, as lower mortgage rates made homeownership more affordable and attractive.

Market sentiment and predictions

The current sentiment among real estate investors is optimistic. Financial analysts predict that the recent interest rate cuts will lead to a similar surge in real estate investments as seen in past rate reduction cycles.

According to Royce Mendes, managing director at Desjardins Securities, the current environment is conducive to a series of rate cuts, which will further support real estate investments. Economists from RBC and CIBC also foresee multiple rate cuts throughout the year, reinforcing the potential for growth in the real estate sector.

Impact of interest rate cuts on different real estate sectors

Residential real estate: The residential sector is expected to see a notable impact, with lower mortgage rates increasing home affordability. Urban areas in particular will experience heightened demand as more people seek to buy homes, leveraging the favourable borrowing conditions.

Grocery-anchored retail real estate: Like other asset classes, the retail sector will benefit from lower financing costs for both variable and fixed debt. The lowered cost of debt benefits not only the property owner, but also the tenant that may rely on credit facilities for business operations. Investors looking for stable returns may find grocery and pharmacy-anchored real estate assets with long-term, brand-name tenants particularly attractive, as tenants with national covenants may promote stability in a portfolio.

Industrial real estate: Driven by the ongoing e-commerce boom, industrial real estate remains a sought-after commodity with continued record-low levels of vacancy in Canada. Lower interest rates will facilitate the expansion and acquisition of warehouses and distribution centers, crucial for meeting the rising demand in this sector.

Strategic investment insight

Given the anticipated market trends, investors may want to consider reallocating their portfolios to include a proportion of real estate assets. Diversification across various real estate sectors can help mitigate risk and maximize returns. For instance, combining residential investments with retail and industrial properties can provide a balanced approach, capitalizing on the unique strengths of each sector.

Conclusion

The Bank of Canada’s recent interest rate cut offers a timely opportunity for investors to re-enter the real estate market. Lower borrowing costs, compressing cap rates, and the potential for rising property values create a favourable environment for investment. By strategically positioning themselves in high-potential sectors and regions, investors may be able to capitalize on the economic recovery and enhance their portfolios. As always, Skyline Wealth Management recommends speaking directly with a Skyline representative to discuss investment strategies that align with each individual’s investment goals.