Despite warnings of potential tariffs following President Trump’s inauguration on January 20, few were prepared for the chain of events unleashed this past Saturday. In an instant, decades of collaborative free trade morphed into a full-on trade war between unwavering allies. Worse, the U.S. flexed its muscle by using its substantial leverage to try to ‘bully’ Canada into submission—a path that, if not mitigated, could lead to recession. With the Bank of Canada forecasting 1.8% gross domestic product (GDP) growth in 2025, few had economic downturn on their radar.

As is well understood, if imposed, a 25% tariff on Canadian exports and a 10% tariff on Canadian energy could pose challenges to the Canadian economy. These facts are indisputable. But despite early signs of an impending trade war with our southern neighbours, is one truly imminent?

While the future is uncertain, interpretive indicators suggest it may be a passing storm rather than a lasting reality. Here’s why:

- Multiple trade wars have started and been postponed within 72 hours, inferring they are being used as a negotiation tactic.

- President Trump’s remarks following the pause give us cautious optimism that lasting trade stability remains within reach.

- Short-term movements in public equity suggest Canada’s tariff crisis has already passed.

Three trade wars ignited and extinguished within 72 hours

While it is hard to believe the U.S. was already embroiled in a prospective trade war before Canada’s conflict, that’s precisely what took place on January 26—less than a week after President Trump took office.

A dispute between the U.S. and Colombia quickly escalated into a trade war after Colombia declined acceptance of two U.S. repatriation flights related to America’s immigration crackdown. The administration responded by threatening punitive tariffs on Colombian exports, while President Petro vowed to retaliate with tariffs on U.S. goods. Fortunately, the situation soon de-escalated after Colombia agreed to accept migrants via military aircraft without limitation or delay.

A few days later, Canada and Mexico were slapped with 25% tariffs on most goods, justified by claims that both countries had not done enough to strengthen border security and curb the flow of fentanyl into the U.S. Yet again, within 72 hours, tariffs on both nations were temporarily lifted after concessions were made to bolster border security.

Do you notice a pattern here?

From our vantage point, it’s become increasingly clear that President Trump isn’t really seeking a protracted trade war—he’s seeking concessions to enforce his domestic policy agenda. Three looming trade wars have commenced two weeks into his administration and ceased as opposing nations ‘bend the knee’ on concessions.

Expect continued compromise to prevail, as Canada cannot out-leverage its biggest trade partner. As long as Parliament Hill stays flexible and responsive to U.S. needs, we believe the odds favour an eventual normalization of trade relations—even if it’s at Canada’s expense.

Concessions set the foundation for lasting trade stability

Although it’s far too early to sound the ‘all clear,’ the swift preliminary resolution to Canada’s tariff dilemma is a positive sign. Notably, President Trump’s remarks following the pause give us cautious optimism that lasting trade stability remains a likely possibility.

Shortly after Prime Minister Trudeau announced a 30-day tariff pause while we work together,

President Trump concluded his adjoining statement that he is very pleased with this initial outcome.

Just as significantly, he added that tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final economic deal with Canada can be structured.

In our view, these statements are far more consistent with a leader seeking trade peace—not lasting turmoil. The plugged-in prediction markets seem to agree, where as of this writing, 63% of participants believe President Trump will remove tariffs on Canada before May.

Public REIT markets pricing-in future trade stability?

While pricing mechanisms between public and private REIT markets often create divergent return profiles, we believe the former provides a reasonable gauge of investor sentiment at any given time. In turbulent periods, public equity movements are the most expedient way to determine how REIT investors are reacting to key developments in real time. Quoting the great Warren Buffett: In the short run, the market is a voting machine but in the long run it is a weighing machine.

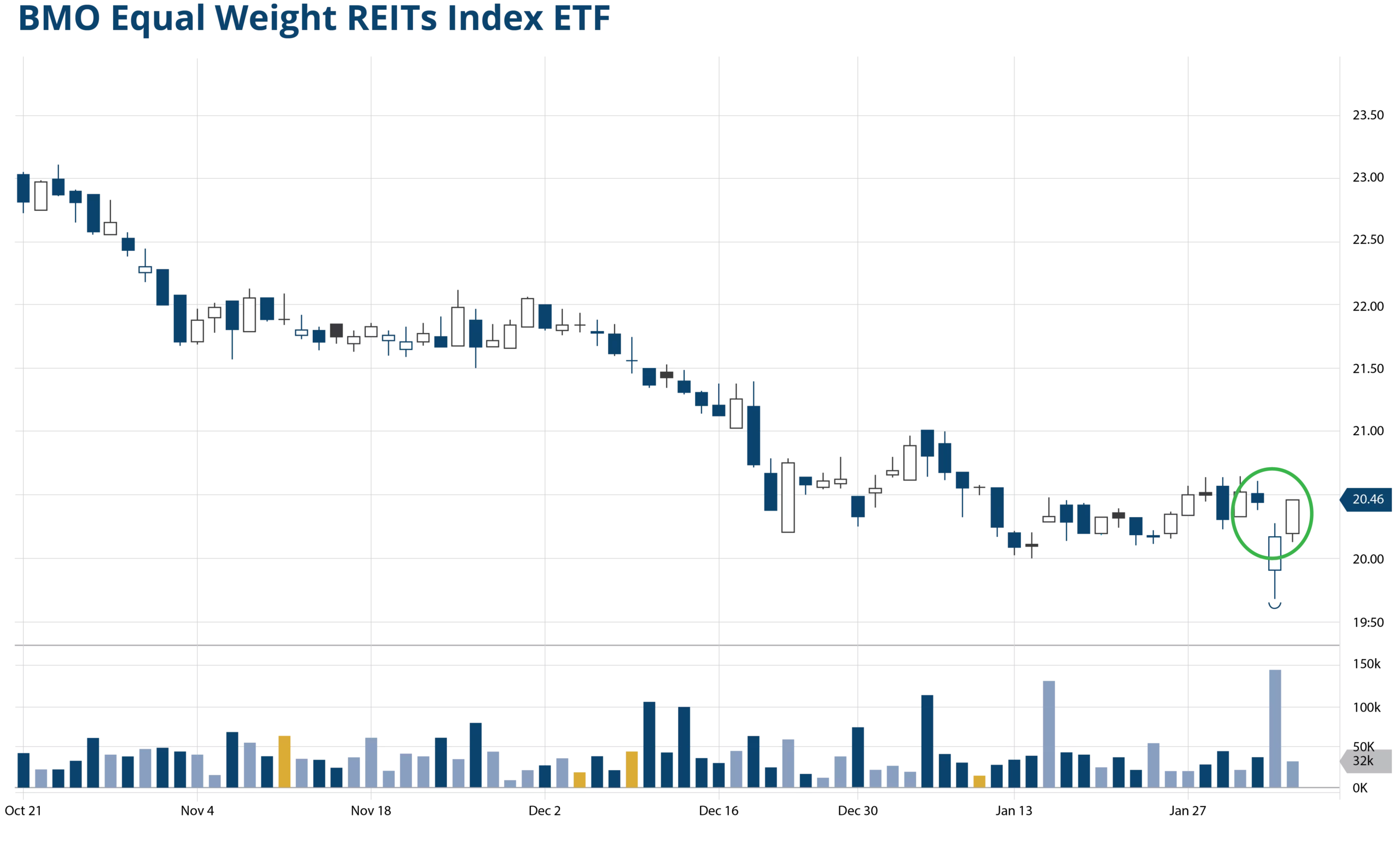

Since the open of Canadian equity markets this week, public REITs, as represented by BMO Equal Weight REITs Index ETF (ZRE:TO), have shown remarkable resilience to the news.

After initially falling as much as 3.72% on Monday morning, ZRE recouped nearly two-thirds of its losses by the close. As of Tuesday afternoon, ZRE has fully recovered, trading above its Friday close as investors capitalize on the price dislocations. It’s like the presumed implications of Trump tariffs never happened.

As public equity markets are a forward-discounting mechanism for future price discovery, time will tell whether they are foretelling upcoming trade stability. Let us leave the predictions to traders. At Skyline, we’re comfortable letting our long-term returns speak for themselves and embrace our position as a ‘weighing machine.’

Stay vigilant, not fearful

Discover how tariffs may affect Canadian real estate and the economy—and how Skyline is strategically navigating the volatility. Click on the video below for more insight from Skyline CFO, Wayne Byrd.

To watch the video, please accept all cookies using the settings bar at the bottom of the page.

About Skyline

Skyline is a capital management company that acquires, develops, and manages real estate properties and clean energy assets, and offers them as private alternative investment products.

Skyline currently manages more than $8.95 billion* across its real estate and clean energy platforms.

With approximately 1,000 employees across Canada, Skyline works to provide safe, clean, and comfortable places for tenants to call home, great places to do business, sustainable solutions for a greener future, and an engaging experience for its investors.

View Skyline’s 20th Anniversary celebration video to see how Skyline is grounded in real estate, powered by people, and growing for the future.

For more information about Skyline, please visit SkylineGroupOfCompanies.ca.

*As at September 30, 2024

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

519.826.0439 x602