A recap of Skyline Industrial REIT’s major transactions and news in 2022, and President Mike Bonneveld’s industry outlook for the next year.

Skyline Industrial REIT, a Guelph, Ontario-based Real Estate Investment Trust focused on acquiring, managing and developing modern warehouse and logistics facilities is marking 2022 as a historic year.

The past 12 months saw significant changes for the REIT as it underwent a strategic shift and was renamed from the previous “Skyline Commercial REIT” to “Skyline Industrial REIT,” to better reflect the evolution of the REIT’s portfolio composition and its increased weighting in the warehousing, distribution, and logistics sector.

In June 2022, the REIT welcomed Mike Bonneveld to the role of President. Previously the Vice President and Director of Acquisitions for Skyline Asset Management Inc., Bonneveld is now responsible for Skyline Industrial REIT’s strategic growth and performance.

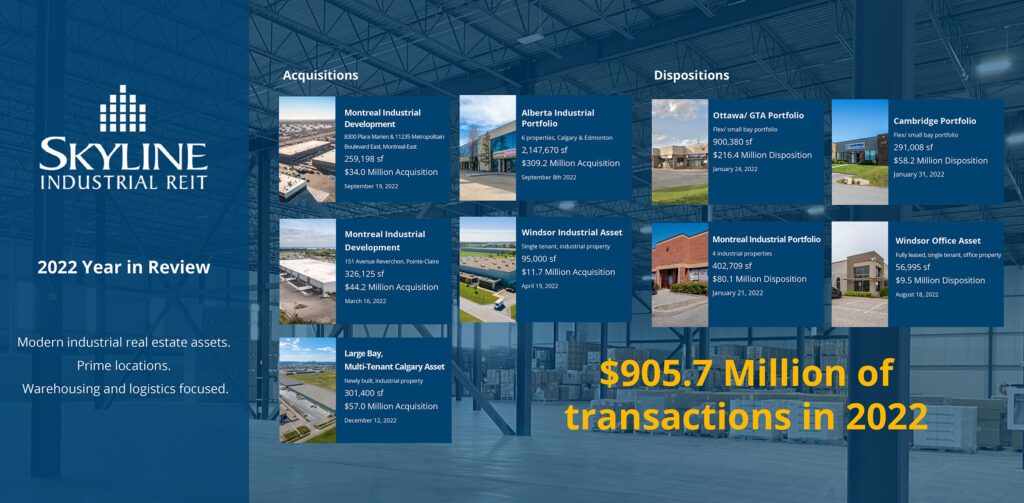

2022 also saw the near completion of the REIT’s strategic disposition program, with only a few smaller assets left for disposition in early 2023. The program, which launched in 2021, focused on disposing of and redeploying non-core assets to further enrich the portfolio with more modern A-class industrial, warehousing, and logistics-focused assets. In total, the REIT completed 8 strategic disposition transactions, totalling 1,801,156 square feet. This resulted in $386.9 million in gross sales proceeds to the REIT.

“These dispositions brought the REIT to an enviable financial position,” said Bonneveld.

“The proceeds from these sales were redeployed toward our established development pipeline and a number of quality institutional acquisitions of modern warehousing and logistics-focused facilities.”

The REIT also broke ground on two new industrial/logistical development projects on the Island of Montreal. The projects, in partnership with Rosefellow Developments and FIT Ventures, are located at 6010 Rue Notre-Dame East, Montreal and 6000 Trans-Canada Highway, Pointe-Claire and are expected to be completed in 2023.

Other key accomplishments for Skyline Industrial REIT in 2022

In total, during 2022, the REIT completed 6 transactions, adding 11 industrial assets to the portfolio, totalling 3,329,393 square feet, for an aggregate gross value of $483.7 million.

The REIT’s first acquisition of the year was a 326,125 square foot, single-tenant industrial warehouse in Pointe-Claire (Montreal), fully leased to Nespresso Canada, and the first acquisition from the REIT’s joint venture partnership with Rosefellow Developments and FIT Ventures, in which the REIT acquired all outstanding partner interest and is now the sole owner.

Skyline Industrial REIT also completed its largest-ever transaction in September. The REIT purchased a $300+ million portfolio of four industrial business parks from a major Canadian pension plan. The properties are located in Edmonton and Calgary, Alberta, and total more than 2 million square feet of industrial space.

Throughout the year, the REIT was very opportunistic, and acquired several individual industrial properties:

- 465-473 Jutras Drive South, Windsor, Ontario

- 6575 68th Avenue SE, Calgary, Alberta

- 454 & 468 Innovation Way, Woodstock, Ontario

- 8300 Place Marien & 11235 Metropolitain Boulevard East, Montreal-East, Quebec

Skyline Industrial REIT is currently comprised of 61 properties in five provinces across Canada, with a total of 9,315,073 square feet of industrial space. 1

“This past year, the REIT has also considerably expanded and enhanced its development pipeline of new logistics and warehousing developments through its partnerships in Montreal, Ottawa and Halifax,” said Bonneveld.

“By 2025, this pipeline is anticipated to deliver more than 3.3 million square feet of premium industrial space across Canada.”

Outlook for 2023

The industrial real estate market continues to experience high demand from both a tenant and investor standpoint.

Commercial Real Estate Services (CRES) Canada estimates that for every billion dollars in e-commerce sales in Canada, approximately 1.25 million square feet of warehouse inventory is needed.2

The short supply of modern, pre-existing industrial space has resulted in the continued rapid escalation of rental rates and historically low vacancy rates across the country. The demand for industrial space has remained strong, with the national availability rate hovering around 1.5% in Q3 2022. Only 9.1 million square feet of industrial supply came online in Q3, failing to make any impact in net absorption as nearly 90% of new developments were pre-leased due to record demand.3

According to CBRE, the industrial real estate market growth shows few signs of slowing down any time soon, with a total national inventory of approximately 1.9 billion square feet of industrial space.4 Another 90 million square feet of space could be needed in the next five years.

In 2023, Skyline Industrial REIT aims to maintain its focus on acquiring light industrial, logistics, and warehousing properties along major highway corridors, transportation routes, and global shipping outlets across Canada.

“The REIT intends to capitalize on this momentum,” said Bonneveld. “We are answering the demand with many new developments in underserved major markets. These spaces will allow tenants to operate more quickly and efficiently. The REIT’s strong balance sheet and excellent financial position will allow senior management to be opportunistic in the coming months.”

Skyline Industrial REIT is now on Fundserve (Code: SKY2012). For more information, please contact invest@skylinewealth.ca or visit www.skylinewealthmanagement.ca/advisory for more details.

1 As of January 13, 2023.

2 So much demand, so little space | CBRE Canada. (n.d.). Retrieved December 22, 2022, from www.cbre.ca

3 Canada industrial figures Q3 2022. CBRE Canada. (n.d.). Retrieved January 18, 2023, from www.cbre.ca

4 19, J., & 18, J. (2022, August 22). The Canadian real estate that smart money still desperately wants to buy: Industrial warehouses – The Globe and Mail Pipa News. PiPa News. Retrieved January 18, 2023, from pipanews.com

About Skyline Industrial REIT

Skyline Industrial REIT (the “REIT”) is a privately owned and managed portfolio of industrial properties, focused on acquiring warehousing and logistics-centred properties along major highway corridors and transportation routes in Canada.

Skyline Industrial REIT is distributed as an alternative investment product through Skyline Wealth Management Inc. (“Skyline Wealth Management”), the preferred Exempt Market Dealer for the REIT.

Skyline Industrial REIT is committed to providing outstanding places to do business and superior service to its tenants, while surfacing value with a goal to deliver stable returns to its investors.

To learn more about Skyline Industrial REIT, please visit SkylineIndustrialREIT.ca.

To learn about additional alternative investment products offered through Skyline Wealth Management, please visit SkylineWealth.ca.

Skyline Industrial REIT is operated and managed by Skyline Group of Companies.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

519.826.0439 x602